Double Entry Accounting Defined And Explained

02 December 2021

Content

Learn the basics of how this accounting system is reflected in journals and ledgers through examples, and understand the concept of normal balances. A list of income and expenses only goes so far in helping you understand your business — especially because a company’s finances involve more than just income and expense. Assets like property, equipment, and machinery may not bring in “income” like cash, but these assets are integral to your owner’s equity and to understanding your business’s overall net worth. Since every transaction affects at least two accounts, we must make two entries for each transaction to fully record its impact on the books.

What is the difference between double entry system and double accounting system?

What is the difference between Double Entry System and Double Account System? … As its name suggests the double account system divides its balance sheet into two sections: the capital account and general balance sheet, whereas under the double entry system only one balance sheet is created.

It will eventually contribute to revenue in the profit and loss account. The bank’s records are a mirror image of your records, so credit for the bank is a debit for you, and vice versa. This system of accounting is named the double-entry system because every transaction has two aspects, both of which are recorded. A debit to some of these accounts, such as Expenses and Assets, indicates an increase. From that, you can deduce that a credit to Expenses or Assets indicates a decrease. If that seems like a lot to remember, you can use the chart in the next section as an easy reference.

Boundless Accounting

Credits increase revenue, liabilities and equity accounts, whereas debits increase asset and expense accounts. Debits are recorded on the left side of the page and credits are recorded on the right. The sum of every debit and its corresponding credit should always be zero.

Accounts Payable (AP) Definition – Investopedia

Accounts Payable (AP) Definition.

Posted: Sun, 26 Mar 2017 05:50:38 GMT [source]

To record a business transaction, companies must ascertain whether the transaction has caused each of the related accounts to increase or decrease. A transaction may cause all related accounts to increase or decrease at the same time or can result in one account increasing while the other account decreases. Revenue is earned when goods are delivered or services are rendered. In double-entry bookkeeping, a sale of merchandise is recorded in the general journal as a debit to cash or accounts receivable and a credit to the sales account. The amount recorded is the actual monetary value of the transaction, not the list price of the merchandise. A discount from list price might be noted if it applies to the sale.

Double Entry Bookkeeping System

The new set of trucks will be used in business operations and will not be sold for at least 10 years—their estimated useful life. Bookkeeping and accounting track changes in each account as a company continues operations. The system also requires skilled human resources with accounting skills and knowledge. Automation of the system means higher costs for small businesses. Suppose ABC company sells its shares worth $ 100,000 to raise capital. The accounting system should be maintained as a separate entity from its owners or users.

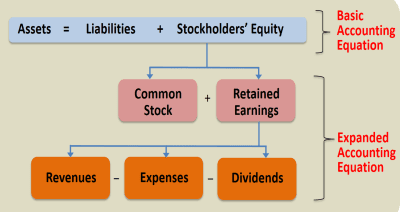

For each transaction, the total debits recorded must equal the total credits recorded.a. For example, if a company pays $20 for a website domain, the cash account will decrease $20 and the advertising expenses account will increase $20. A double entry accounting system established the accounting equation where assets must always equal liabilities plus owner’s equity.

Accounting Entries

Generally, business transactions involve one or more “debit” entries and one or more “credit” entries. For every transaction recorded, the debit entries should equal the credit entries.

Double-entry bookkeeping is based on balancing the accounting equation. However, satisfying the equation does not guarantee a lack of errors; the ledger may still “balance” even if the wrong ledger accounts have been debited or credited. There are two primary accounting methods – cash basis and accrual basis. The cash basis of accounting, or cash receipts and disbursements method, records revenue when cash is received and expenses when they are paid in cash. In contrast, the accrual method records income items when they are earned and records deductions when expenses are incurred, regardless of the flow of cash.

Examples Of Double Entry In A Sentence

Real accounts mean assets owned by a business such as machinery, equipment, land, property, and so on. There are two sides to each transaction, a debit, and a credit. It means there are always at least two parties involved in every accounting transaction, a giver and a receiver. A double-entry is an accounting system that requires at least two entries for every transaction. Earlydouble-entry bookkeepingand the rhetoric of accounting calculation, Thompson, G. This paper explores the various ways in which accounting is approached.

A £500 credit to the inventory account These entries would allow John to better track his total profit, as the following equation illustrates. The company may also provide Notes to the Financial Statements, which are disclosures regarding key details about the company’s operations that may not be evident from the financial statements. When a business enterprise presents all the relevant financial information in a structured and easy to understand manner, it is called a financial statement. The purpose of financial statements are to provide both business insiders and outsiders a concise, clear picture of the current financial status in the business. Therefore, the people who use the statements must be confident in its accuracy. Expenses reduce revenue, therefore they are just the opposite, increasedwith a debit, and have a normal debit balance.

The first book on double entry system was written by an Italian mathematician Fra Luca Pacioli and his close friend Leonardo da Vinci. The book was entitled as “Summa de arithmetica, geometria, proportioni et proportionalita” and was first published in Venice in 1494. Pacioli and da Vinci did not claim to be the inventors of double entry system but they explored how the concepts could be used in a more efficient and organized way. Equity is the residual claim or interest of the most junior class of investors in assets after all liabilities are paid. An expense is money that has been spent, while a liability is money that is owed. For example, going to the office supply store and purchasing supplies is an expense.

Debit accounts are asset and expense accounts that usually have debit balances, i.e. the total debits usually exceed the total credits in each debit account. The basic double-entry accounting structure comes with accounting software packages for businesses. When setting up the software, a company would configure its generic chart of accounts to reflect the actual accounts already in use by the business. Credits to one account must equal debits to another to keep the equation in balance. Accountants use debit and credit entries to record transactions to each account, and each of the accounts in this equation show on a company’s balance sheet. The double-entry system follows the principle of the basic accounting equation. It leads to the accuracy accounting function where all debits and credits must equal at any given time.

Want More Helpful Articles About Running A Business?

Every transaction and all financial reports must have the total debits equal to the total credits. A mark in the credit column will increase a company’s liability, income and capital accounts, but decrease its asset and expense accounts. A mark in the debit column will increase a company’s asset and expense accounts, but decrease its liability, income and capital account. It’s easier to explain debits and credits as accounting concepts, as opposed to physical things. Every transaction within your business produces a debit in one account and a credit in the other.

- Given his calling, Pacioli must have been a man of considerable education and wide-ranging interests.

- The transaction is recorded as a “debit entry” in one account, and a “credit entry” in a second account.

- It may help you to remember the rules if you keep in mind that assets in the balance sheet and costs in the profit and loss account are both debits.

- For example, if your business secures a bank loan for $20,000, the loan is debited under “Assets” on your balance sheet because it represents an increase in your assets.

- To illustrate double entry, let’s assume that a company borrows $10,000 from its bank.

Double-entry accounting is a way of recording bookkeeping transactions, where each transaction affects at least two accounts. In double-entry accounting, the debits must always equal the credits.

Double Entry Bookkeeping Definition

By logging both credit and debits in a double-entry bookkeeping system, you can accurately record your financial information. A business must keep as close an eye on its income as it does on its expenses, which is why every business needs to use double-entry bookkeeping. By having all this information to hand, companies are also better able to forecast future spending. Thus, the asset account is increased with a debit and the liabilities account is equally increased with a credit. After the transaction is completed, both sides of the equation are in balance because an equaldebitandcreditwere recorded.

Simply stated, assets represent value of ownership that can be converted into cash. Two major asset classes are intangible assets and tangible assets. Intangible assets are identifiable non-monetary assets that cannot be seen, touched or physically measured, are created through time and effort, and are identifiable as a separate asset. Current assets include inventory, while fixed assets include such items as buildings and equipment. Notice that assets are on the left, or the debit side of the equation, and, as we noted earlier, assets have a normal debit balance. Liabilities and equity are both on the right, or the credit side of the equation, and both carry a normal credit balance.

Switch To Smart Accounting Try Zoho Books Today!

This is a debit to the wage account and a credit to the cash account. This means that you are consuming the cash asset by paying employees. Bookkeeping can be complicated businesses of any size, and double-entry bookkeeping, all the more so. Here’s a closer look at this financial process and how understanding double-entry bookkeeping can help your organisation.

What are the advantages and limitations of double entry system?

Since personal and impersonal accounts are maintained under the double entry system, both the effects of the transactions are recorded. It ensures the arithmetical accuracy of the books of accounts. For every debit, there is a corresponding and equal credit. It prevents and minimizes frauds.

In the sixteenth century, Venice had trade relations with different parts of the world through various channels. The double-entry system was introduced in Great Britain and other parts of the world, eventually making its way to Venice. Without an audit trail, there is no repeatable process for finding and fixing errors. Get up and running with free payroll setup, and enjoy free expert support.

A general ledger is the record-keeping system for a company’s financial data, with debit and credit account records validated by a trial balance. Double entry system is the most advanced and useful form of maintaining accounting records and is extensively used by companies worldwide. Without this system, a company would not be able to compare its financial statements with that of other companies. Under double entry system of accounting, the two aspects of each transaction are recorded (i.e., for every debit there must be a credit and vice versa).

The Financial Accounting Standards Board governs the generally accepted accounting principles , which are the official rules and methods for double-entry bookkeeping. Small businesses with more than one employee or looking to apply for a loan should also use double-entry bookkeeping. This system is a more accurate and complete way to keep track of the financial situation of a company and how fast it’s growing. When a company pays a six-month insurance premium, the company’s asset Cash is decreased and its asset Prepaid Insurance is increased. Each month, one-sixth of the premium is recorded as Insurance Expense and the balance in Prepaid Insurance is reduced.

The concept was discovered and formally documented by Luca Pacioli, a monk from Venice who included double-entry in his encyclopedia on math in 1494. It is believed that the publication of Pacioli’s book helped to popularize the idea of double-entry bookkeeping. The financial reports and results generated by double entry system is reliable to great extent for decision making purpose.

This is basis for recording all modern daybusiness transactions. Liabilities and equity affect assets and vice versa, so as one side of the equation changes, the other side does, too. This helps explain why a single business transaction affects two accounts as opposed to just one. For example, when you take out a business loan, you increase your liabilities account because you’ll need to pay your lender back in the future.

So this amount is debited to your account and raises the account balance to $4500. The entry is a debit of $8,000 to the cash account and a credit double entry accounting definition of $8,000 to the common stock account. When a company’s software prepares a check, the software will automatically reduce the Cash account.

Double-entry accounting isn’t a requirement while balancing your books, but every business should consider using it. This is because double-entry accounting helps you more easily spot errors and increases your accuracy. It also gives you an accurate view of your company’s finances and makes it easier to prepare financial statements. When entries are made in the double entry system, there must be a debit entry and a credit entry into the general ledger. A debit records an entry on the left side of an account ledger, while a credit records an entry on the right side of the ledger. The totals for all debit entries made must always match the totals for all credit entries made; when this is the case, an entry is said to be in balance.

Author: David Paschall